For many years, he has been a leading attorney representing competing businesses.Now Wes Hall is dealing with assaults inside and outside the bedroom.

On a Monday morning in early January, he was presiding over his meetings when suddenly the waters of the Towanto began to flow.

Buckets were placed around the room to contain the damage, but the space smelled like an outhouse.Kingsdale had to send everyone home while maintenance crews were called in to investigate the problem.

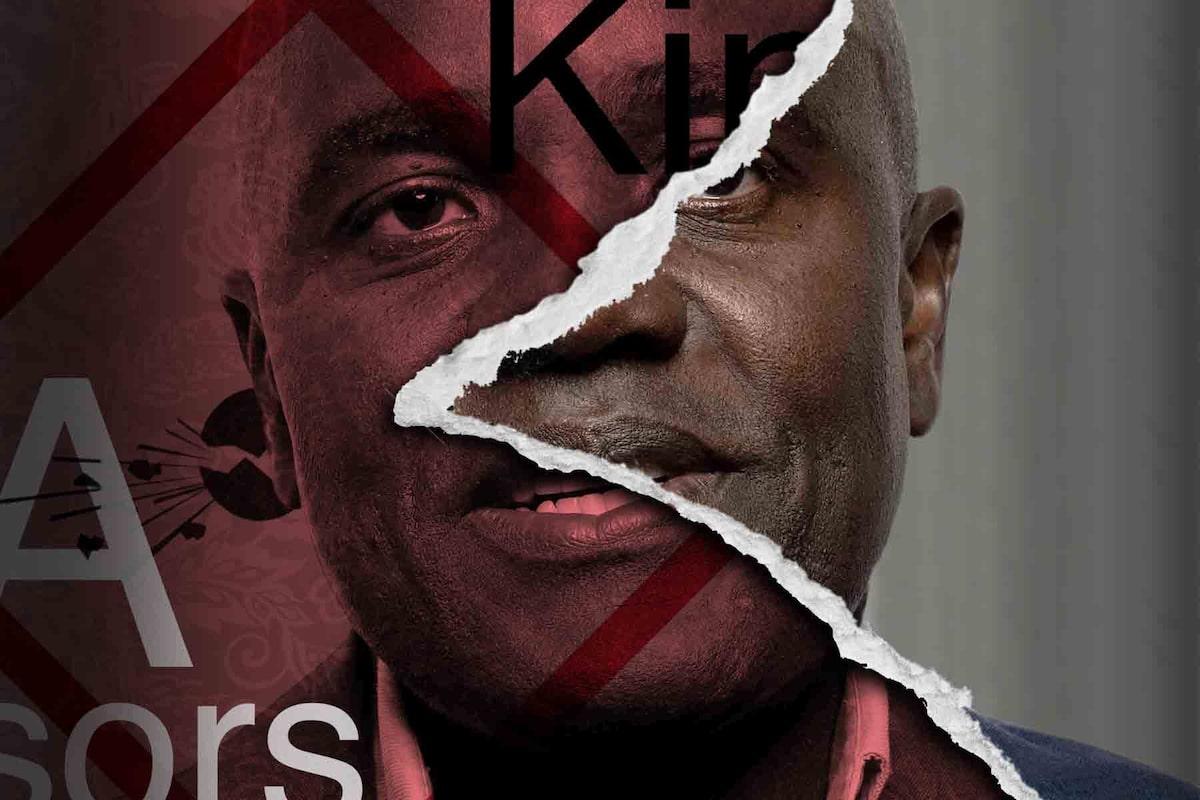

In a year full of setbacks, the letter made a lot of sense to employees at Kingsdale, the equity advisory firm founded by Bay Street mogul Wes Hall, who is known to average Canadians as a celebrity investor from the reality show Dragon's Den.But he is also the current Chancellor of the University of Toronto, the most successful black male in Canadian business and the Black North.is the founder of the initiative.

Kingsdale has been battered by one blow after another: an exodus of executives, a lawsuit alleging a toxic work environment, a public loss in one of the most high-profile activist fights in recent history and growing signs that competitors are stealing the firm’s market share.

Launched in 2003, Kingsdale has been the dominant player in an important but niche industry on Bay Street.The firm is a proxy attorney, meaning it is hired by publicly traded companies (or activist investors) to win over shareholders.Attorneys at law are involved in hostile takeovers, governance struggles, mergers and acquisitions and meet daily.

Kingsdale has had great success in the House of Lords and has been recommended for proxy solicitations and a seat at the bar.

But recently, Kingsdale's rule has been tested.

When Mr. Hall started Kingsdale, there was only one lawyer in town - his employer, Georgeson Canada.

Today, the field is limited, with about half a dozen other shops, including Laurel Hill Advisory Group, Sodali & Cohaners.You LABSELTS PARSONS, TMX Investor Solutions, exited Canada In late September, a company official confirmed that shows how strong the market is.)

Mr. Hahn changed the game by expanding more strategic and management skills. Kingsdale's clients include work-system services and glass companies and glass Levies. But later, rivals copied Kingsdale's model. Their fees were lower.

These are some of the problems Kingsdale ended up on the losing side of a nasty legal battle between Gildan Activewear and US West Investment Fund early last year.

Then, in the late summer of 2024, most of Kingsdale's executive team—the chief executive, the president, an executive vice president, and two vice presidents—walked out the door within weeks of each other.Mr Hall went on damage control duty, assuring customers it was business as usual.He announced that he would step into the role of CEO himself, after spending years as executive chairman.

But then one of those late bosses, former boss Grant Hughes, sued for unfair dismissal saying Kingsdale had become a toxic work environment because of Mr Hall.In a statement of defence, Mr Hall denied the allegation and accused Mr Hughes of being "the architect of his own departure".But the process was remarkable because it exposed an allegation that had been quietly discussed in the industry for years: that the work for Mr. Hall was not Easy.

Tensions flared further in April after Hughes and another acting executive, Anna Ferdendes, launched a competitor to Kingsdale, Hermetic: a proxy firm called Debt Partners. The couple sued the couple for breach of contract after warning them about Kingdale.In the lawsuit, which was tried and no statement of defense was filed, the firm accused the former executives of possessing the former executives of the former executives.

If all that wasn't enough, one of Mr. Qm's Hall companies asked the judge to approve a $14 million loan agreement from Weshall Investments, Weshall Hall's company, which owns 90 names of QM common stock.

Over the past year, The Globe and Mail has documented the challenges in Kingsdale.Through interviews with more than 40 people at the heart of Kingsdale's growth – including former Kingsdale and WeShall employees, customers, competitors and Bay Street lawyers – as well as a review of thousands of pages of legal documents, a picture has emerged of a company, an industry and a man at a crossroads.

The report sheds new light on Mr. Hall's departure from Georgeson Canada, friction in the Canadian Pacific Railway replacement battle that shaped his career and what it's really like to work at Kingsdale.

In one September and the end of September, Mr. Hall agreed to a short but comprehensive interview.

“Our customers expect the best from us,” Christian said.

The manager and his wife also resigned for their own reasons.One of them, Kelly Gorman, became CEO of Advocacy, and others started their own businesses.

He rejects the idea that Kingsdale is lagging behind its competitors, but also admits the field is big and the industry can't handle it.

"We don't know when the next contract will come. And we've got 10 players at the moment," said Mr Hall, 56.

Jennza behind Mr. Hall's desk in Mandale, Mr. Hall's family movies and bags are in free figures. But there is a picture of the sun or Mr. Hall in Haaral Jamaica Village, front and center.

It is a reminder - for him and those who visit - that he fought hard to get to where he is now.

Your remarkable story has been allowed many times in the essay, as well as his best long and memorable essay, no bootstraps when you are barefoot.

Born into poverty, Mr. Hall immigrated to Canada as a teenager to live with his father.He worked at a postal law firm and attended night classes at George Brown College to earn a law degree.He got a job at CanWest Global Communications, and then, in 1998, Mr. Hall moved to CIBC Mellon, where he learned about the business through exposure to authoritative figures.

At the time, CIBC Mellon was the transfer agent, which performed tasks such as maintaining the company's shareholder investment records and overseeing its AGM.Due to the nature of the work, the transfer agent is in regular contact with the power of attorney.

In this same era, PH Bocionina started building his network, today it is the envy of Bay Street.He stands at the registration table in Sambel and greets the CEO, board members, all Numenari with warmth, smartns and Kapintonan with courage.He collects business cards with notes written on the back of each one.

It was through his work at CIBC Mellon that Mr. Hall met Glenn Keeling, CEO of Georgeson Canada.

Georgeson & Co. was founded in New York during the Great Depression and was acquired in 1999 by Shareholder Communications.This new business wanted a Canadian office and called Mr.Keeling, a gregarious salesman with a mop of orange hair, to run it. Keeling was impressed with Mr. Hall and offered him a job as vice president of business development.While Mr.Hall didn't know much about being a lawyer, he was a top priest in 2002.

One industry expert said Mr. Hall was a phenomenal salesman with a very natural ability to read people.If someone didn't buy what he was selling, he could immediately turn around.

In those days, Mr. Hall’s office was beside Mr. Keeling’s. Around the corner was a bank of desks where David Salmon, Christine Carson and Susy Monteiro sat. (Penny Rice came on board a couple of years later.) People who know the proxy solicitation industry will recognize these individuals as the current chief executives of Laurel Hill Advisory Group, Carson Proxy Advisors, Sodali & Co (Canada) and the Shorecrest Group.

But then Georgeson had no competition and business was booming.Behind the scenes, conflicts arose between Mr. Killing and Mr. Hall.

"One of the problems facing my boss is that I - I said - I said - I am a good customer, because I worked on customer files," said Mr.Hall.mr.Hall wanted to just get customers through the door and send them to the management team.He wanted to work with them.

Things happened after the arrival of Mr.Hall to a client that Mr.Keeling.Later, Mr.Hall in a meeting with Thomas Baskets - the president of the parent company - asked for a personal word.

“He told me he wanted to run the business,” Mr. Kies recalled."I was surprised. In a good way. I got negative reactions at first, like 'Are you kidding me? You're just getting started,' but I appreciate the entrepreneurial spirit."

Mr. Total Know She said she told him Hall when he would appreciate his greeting and regards, Mr.Hanp.mau's Mr.Current Mr.PIE, but Georgesona can be introduced to Georgon who did not leave him.

"Of course, it's gone," Mr.Yuam Sij."And we're all very proud of him. He's a great graduate at Georgeson U."

When asked about his days at Georgeson, Mr.Holler said: "We had a lot of fun. We had a lot of fun.

Mr. Hall says he does not remember this conversation with Mr.He maintains that he is not interested in the job of manager.

What happened, Mr. Hall said, was that he tried to convince headquarters that Georgeson needed to change its business model.

Power lawyers should think about three types of investors, Mr.Hall explains. There are registered shareholders who buy directly from the company and whose names are available, and then those who buy through a financial intermediary.These investors are divided into two groups: non-encumbrance beneficial owners (NOBOs) - whose identities are known - and encumbrance beneficial owners (OBOs) - who choose to keep their information private.

"Georgeson focused on calling non-objecting owners and registered owners," Mr Hall said.However, he did not vote.The power was OBOs, which can often find large institutional investors.

OBOS can't be defined, it just requires thinking and feet to connect with portfolios or connect with funds, portfolio managers and continue to participate in larger communities.

But George didn't care.

So Mr.Hall decided to build this new business.

Around this time, Mr. Hall was talking to an acquaintance about his idea for a new type of power of attorney. The man, Peter Notidis, was the chief financial officer of the financial company Kingdale Capital.Mr. Notidis is related to Mr. Hall and his founder, Joseph Duggan, who remembers Mr. Hall fondly: "He was very bright and passionate."

They made Mr. Hall an offer.For 25 percent of Mr.Hall, Kingsdale Capital would provide Mr.Hall office, access to the Kingsdale name and support services.Although there was no financial investment, Mr. Hall believed that the legitimacy of a Bay Street address would bring value.He took out a $100,000 loan and incorporated Kingsdale Shareholder Services (as it was then called) in June 2003.

Mr Hall remembers arriving at his office in the Kingsdale capital on his first day.The receptionist led him down a classically decorated hallway, past wood paneling and mahogany-hued desks, to his room: a small office in a back hallway where the walls were neon yellow.

"At the end of the day, I brought my clients because I brought my clients, and because I brought my clients, I brought them to the fanchal interval." "I don't know anybody in this prison," Mr. Holt said.

Mr. Hall called everyone he knew, especially Bay Street lawyers, who have influence over whether their clients hire a lawyer.Through Cassels Brock & Blackwell, Kingsdale's first client was Vector Aerospace.

To this day, the key to Kingsdale's success is Mr.Hall with a great corporate lawyer.This is especially true with respect to Norton Rose Fulbright, whose chairman - Walied Soliman - has been one of Mr.Hall.They are also business partners.Company files list Mr. Soliman as president of 2539593 Ontario Inc., which owns 10 percent of QM GP's common stock.The bond between the two men was considered so strong that some Bay Street lawyers said they became wary of referring work to Kingsdale, because they worried the firm was too loyal to Norton Rose.

Kingsdale's communications director, Aquin George, said in an email: "Our relationship with Norton Rose is no different than the one we have with many of the leading companies in the market."Mr. Soliman declined a request for an interview.

Mr. Hall did not immediately land other clients, starting with leitch technology.He defeated Joe Moranson Canado in a fight.Prices Expanded Kingsdale and Mr. Hall developed a reputation for winning, so customers were willing to pay.According to Mr. Hall's Recollections, by the third year in business, the business has 20 employees and a profit of more than $7 million.

Others took note of Kingsdale's success.Some of Georgeson's staff -- including Mr. Keeling, Mr. Salmon and Ms. Carson -- traveled to Laurel Hill to start the advisory group.(Gorjoson closed its Canadian office in 2015.) Meanwhile, Mr. Hall bought Kingsdale Capital's stake in his company.

Ms Carson said Hall had three things on his mind: his sales ability, his relationship with his lawyer, and his time.KingsDale launched simultaneously at the Canadian Stock Exchange began to see more activity.And the turning point came in 2011 when the growth of the American Activist Fund guarantor, led by Bill Arman, followed the CP railroad.

Pershing Square's play to reshape CB Rail's board and management was a bold one.Its board includes some of the biggest names in Canadian business, including former Royal Bank of Canada CEO John Cleghorn, Suncor Energy CEO Rick George and former deputy prime minister John Manley.

Mr. Stone advises Kingsdale to hire Kingsdale Square to hire Kingsdale Square.Against the odds, Mr.Ackman.

It was wake up time for the tables.If CP Rail's blue-chip management team could collapse, everyone was vulnerable.For Kingsdale, CP Rail was a great moment.The win became a marketing goal for Kinsedal, and as the years went by, the talk on the street was that Mr. Hall was Mr. Ackman's secret tool.

But of the real people, speak her, Mr.CONTRIBLE MY Mr.BOLE he was a higher performance.And, in, the responsibility of the group is returned to the case due to a problem "competition".A time, there is a problem with the phone center.

"Wes had a great job, a great job," said one source, who declined to be named because he was not here to discuss the deal."But there are some problems."For example, they say, another problem — which isn't a fault — is the delay in the CPA maintenance process by each category.

Another source said they remember the criticism leveled at Kingsdale, but that it may not have been warranted.Pershing Square was a demanding client.

At the time of the Rail Gai Ga and the King, Oticia Oticia Oatisker, is the most important thing of kings. "

Asked about the allegations that Kingsdale had performance issues on CP Rail, Mr. Hall said: “Not to my knowledge.” He added “but they paid us 100 per cent of the fees and they gave us credit for the win.”

"There's always pressure in every rep battle, and at the end of the day, maybe you should do more, maybe you should do less," he said. "It's about results."

Whatever happened on the scene, Kingdale became irresponsible.

Around the same time, there were media reports that Kingsdale was involved in 85 percent of the country's proxy battles.According to two former Kingsdale employees, the firm's profit margins were around 70 percent.(In recent years, profit margins have typically been in the mid-50s.)

At that peak, Hall sold a majority stake in Kingsdale to MDC Partners in 2014 for a sum of about $50 million.(A few years later, after MDC ran into financial difficulties, Mr. Hall bought the company for a fraction of the cost.)

Each of the following years is known as the golden years of the Golden Age.

Jonathan Pinto led D.F.King Canada (later TMX Investor Solutions) in 2019.The battle against Kingsdale was a constant battle, he said.

"Kingsdale and Wess are synonymous with the industry," Mr Pinto said."I would literally talk to a CEO who has no background in brokerage and start talking about what we do and he would say, 'Yeah, like Kingsdale.'"

But the newest experiences changes changes.

Instantiating the stock market in the Proxy Above business is difficult because much of the work will generally not continue.But there are some indications that a landscape is already there.

World 2020, 2023 and 2025 (from October 10 to October 20) Carson Proxy-Hill Advisors, Sodali and CO (Canada), Shorecrest Group Advisors, Shorecrest Group and Tmx Investor Solutions - Carson Proxy Advisors, Sodali Group Solutions rated.The analysis involves searching a variety of documents, including news releases, circulars and proxy forms, followed by manual review.(In 2020, SOLIY & CO (Canada) and Tmx Investor Solutions became D.F. Canada Canada, not Sodali Advisors in Canada.

Five years ago, 167 authorized officers were now out of work, about 44 percent in the 4th, and Laurel Hill had 32 files and 11 percent.But data suggests that Kingdale's market share is steadily declining.And by 2025, out of 155, the King revealed that 42 percent of the top performers work in only four quarters.

Bloomberg also captures this market through its international schedule.Kiingdale has written as proxy 1 Canadian Noxadior on the way to represent the company - there is another part of the manager's presence, which in Carson Proxy dominates in Laurel Hill.The war returns to the first level of 2025, but this is not an overview of the spring section.Carson Proxy, Laurel Phill and Sodali There is any stability of the company's practice and analysis, but Kiingdale only shows the company's work.

Mr saidWherr is a good thing that is a bad thing that is a lot of their messages, we have not been reported

Still, the SEDAR statistics are in line with what industry experts and lawyers say is the general trend. That means companies are increasingly hiring Kingsdale's competitors.

A senior lawyer for Senior Street said Kingdale was doing a good job, as was everyone else.This was not the case ten years ago, they said.

Part of the problem is the cost.

Kingsdale has created a playbook that the competition has imitated and is now offering at a discounted price.The service is also heavily commoditized.For example, today, unlike 20 years ago, there are many shareholder intelligence databases that make identifying OBOs much easier.

It's not just the start-up costs.

Regumdale's actions have led to several lawsuits over the years, including the recent Blockbuster trial in which Spratt Asset Management was ordered to pay US$4.6-million in royalties.Although the company claims that after months of retaining Kingsdale, Spratt decided to go in a different direction.is closed"He made an unfair attempt to obtain payment from Kingsdale for work he did not perform," Spratt's statement of defense read.

But the judge concluded that Spract, which chose to close Kingsdale Out, had not severed ties between Kingsdale services and the latter operation.The matter was appealed.

One of the strongest examples of the price difference between Kingsdale and the competition occurred with the Gily agent fight.

In December 2023, Giristan administration admired the money to shoot Cedo Glenn Chamandy.Tegelijkertijd begon een van de t-stative atcher-fabrikanten van T-Brown Laling te werken om hem terug te brengen.Gildan's Goisdale and law firm Torkan helped them win.The war was confusing, with both sides pretending there were other ways. But in this way, Browning West's greatest success was that Mr. Chamandy was reinstated

Kingdale sent an invoice to Gildan for $2,343,736.78.Gildan should have been encouraged to stay earlier, as it was clear that the Board was looking out for the shareholders.After that word came from that Browning West profiler, Carson's representative, that he charged about $500,000 - for his winnings.

This is the other factor at play: increased competition.

While Gildan Carson's victory put proxies on the map, Ms. Carson has long been known in the industry as a silent assassin - as activist investor Simpson Oil Ltd.Earlier this year, he successfully replaced Parkland Corp.'s board of directors.sued, he hired Carson Proxies - who do great work at relatively low prices.Carson Proxies Bloomberg's #1 Proxy in Canada on the Active Side by 2022.

When asked about her compensation, Carson says she knows she's undercutting: "When I get a call, I'm afraid of missing out. I pay the price because I want to make it as easy as possible for them to say yes because I want to work on it... I love the competition that brings proxy battles. Strategy. Tactics."

Mr. Salmon, Laurel Hill's managing director, said one reason was that he was attracted to his firm's sustainability.There has been zero turnover at the executive level, he said, in more than a decade, and very strong retention at all levels.In a knowledge-based business, that continuity is invaluable, he said.

"We don't lose many people and it's about culture", he said.

Which brings us to the last reason industry insiders say Kingsdale is no longer a controversial leader: its culture is a problem.

The Globe interviewed 16 Kingsdale alumni about their time at the company.Many described an exciting work environment that also happened to be a meat grinder.

Over time - from nine or 10 hours a day in the summer to 14 hours a day, weekends.The workers were not well-rewarded for the amount of work and pressure.Faithful, not a child laborer.Researchers come in at $55,000 a year, while editors can start at $70,000 - a tough job that requires living in Toronto and long hours.fees.Mr.Hall Free employees dislike it.

Former employees say Mr. Hall's philosophy was to move people down the pay scale and then make them prove they were worth more.For those who stayed, there were often raises and offers of several thousand dollars a year for the first three or four years.

Kingsdale Alumni said they didn't mind Mr. on Bay Street.Mat Hall - Mr. Mat Hall - Mr. Having the opportunity to work with the biggest companies with the biggest companies with Hall - it was a valuable experience.

But it wasn't for everyone.

Bernda Simon joined as vice president of communications in 2012. Mr. Simons learned a lot, but he learned it after a year.

"I left because like I said, it was very sad...no, in a warm, compassionate way."

Mr. Simon says he remembers sitting on the subway on his way to work, nervously waiting for the train to catch the signal again, "so I can look at my BlackBerry and see what Weiss wants from me immediately," he said.Applications will come in at any hour and on weekends.Response times were almost always tight, sometimes to no avail, Mr. Simon said.

Some staff said that one day, Mr. Hall would tell them they were amazing, and then suddenly, there would be a change. He would become cold and stop answering their e-mails or giving them face time.(Asked about this, Mr Hall said: "I think that's how people feel. They're not feeling it.")

In Mr. Hall's opinion, everyone is replaceable, so he doesn't care if the three former Kingsdale staffers don't like people.

Many interviewees said the environmental race was lost on them.Mr. Hall is one of the most successful black men in the country.Would it feel different if it was a hard white boss?He was also an amazing overcomer of obstacles.Even those who had negative experiences with Kingdder said Mr. Chambers was unable to respect the independence of the business and black community.

However, the company's culture remained a challenge throughout its existence, even during Mr.Hall is not involved in day-to-day operations.

In 2017, Mr. Hall stepped down as CEO and named Amy Friedman as his successor.Mr. Hall assumed the title of Executive Chairman and then devoted himself to his other business endeavors.As president, Mr. Hall dealt mostly with Kingsdale's senior management, but employees say the tone of the organization was still from the top.(Ian Robertson took over from Ms. Friedman, who left in 2021. He was one of the executives who quit in 2024. Shortly after leaving, he started a management consulting firm called the Jefferson Hawthorne Group.)

Storage is another perennial issue in Kingsdale, especially in recent years.

Until the year 2025, Kingdale (who shares with other senior staff) has a CFO, Chief of staff, its general head, other guardians of the management concerned, among others.

Employees say the company can be heartless.

In one example, detailed in court records, Kingsdale's former vice president of finance sued the company for wrongful termination after allegedly being fired after disclosing a cancer diagnosis.

According to the lawsuit, Brian Ilavski told his employer on Feb. 27, 2012, that he had been diagnosed with stage 4 colon cancer."On Wednesday, February 29, 2012, Mr. Hall met with Mr. Ilavski and terminated their employment."The next day, a termination letter was sent to Mr. Ilavski's home.Kingsdale's actions resulted in Mr. Ilavski's "current condition adversely affecting his ability to cope and recover from the medical examination."

In his defense, Kingsdale stated that there were problems with Mr. Ilavsky's performance and that, despite training, things did not improve.Kingsdale said that on February 13, 2012, Mr. Ilavsky was informed that "his employment will be terminated."The filing said the law firm had no knowledge of his medical problems.In response to these allegations, Mr. Ilavsky's lawyer rejected this version.The former financier executive died in July 2014, but Kingsdale continued to fight his widow in court.The matter was eventually settled for an undisclosed sum.

Kingdale is also known for sending legal threats to leave employees, accusing them of stealing confidential company information while taking on a new role.The Globe reviewed two such letters and shared other details that cannot be separated because of the way the case was handled.

When asked about these threats, Mr. Hall said that it is common practice in the business sector to protect proprietary information and while the company defended the lawsuit, we did not raise the issue with the employees.

But in 2022, on her first card, Ms.ua ms.for a job at Ewing Morris & Co. Humans was completed, ending a Cancelale client, reit.

Ms. Friedman declined to comment on the lawsuit.

Bilal Khan, who has been the managing partner of Washal, until last month, said that Mr.he is understood.

"Sure, he has a reputation. And it's true: Wes is very demanding. He's a perfectionist in many ways... I don't think you'd get where Wes is without that kind of work ethic. He's the first guy. The last guy," Mr. Khan said.

Mr. Iran says the only reason why he has left lashel was because of the problems in QM GP, who will ask a great proposal.He wants to focus on new business.

A senior Kingsdale employee who, like Mr. Hall, is black, said he heard some of the criticism Mr. Hall made.But for him, it's clear that the Kingsdale founder holds him to another level.

There are many successful white men on Bay Avenue who demand leaders.

"No one asks them how they make money. Or who they fire to find out where they are."

In July 2024, a frustrated Mr. Hall held a meeting with his management team.

"Who would have thought it would be a $50 million business?"Mr. Hall asked the group.(According to company sources, Kingdale was modestly doing about $20 million in annual revenue.)

Newer managers raised their hands.But those who had been longer hesitated.They told Mr. Hall that the metric didn't exist.The market was saturated with competition and business was changing.Labor became commoditized and customers were no longer willing to pay so much for services.

Mr. Hallus accused the executives of denial and insisted that he stay with the council. This meeting, according to sources in the room, convinced some executives that it was a long time to leave.They were worried that they would fail.

Still, WeShall's Mr. Khan was at the meeting, and he doesn't think Mr. Hall had a target base.He thought some executives' pushback on fees was misplaced: "I think they were looking at the wrong metric. They have Wes Hall at the helm. Wes might get a different premium than I think most people."

Mr. Hall has a magic touch, Mr. Han said.

“I wouldn't bet against Wes Hall.”